Provider Category: Card Management

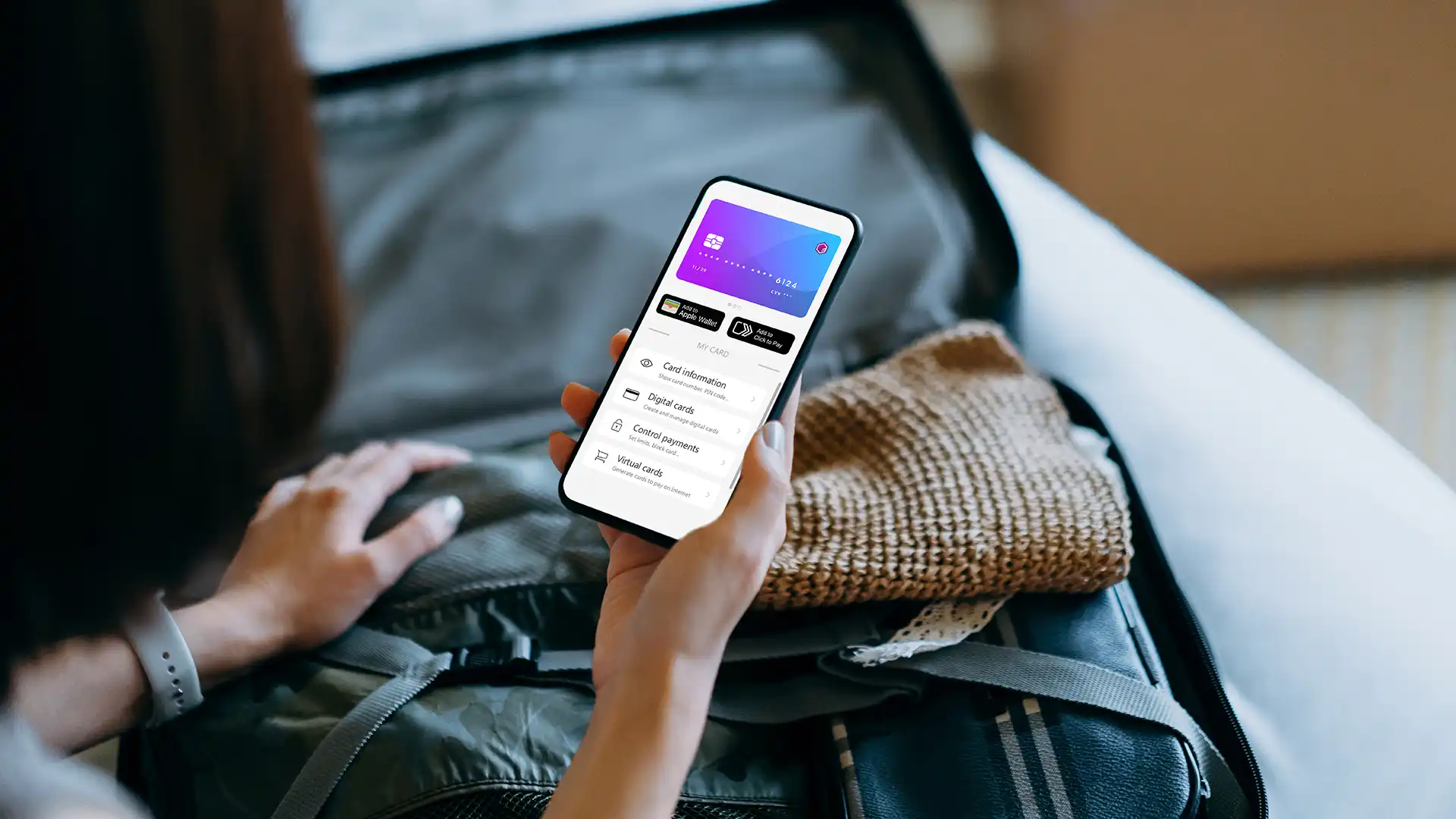

Instant digital issuance. Secure payments. More value in your app

Entrust Digital Card Solution empowers banks and other card issuers to enable instant digital card issuance, secure provisioning into 3rd-party wallets, and seamless payment experiences directly in their banking app. Offer features like push to wallets, NFC Issuer Wallet, and Pay by Account—supported by Visa and Mastercard certifications for secure yet convenient digital payments.

Key benefits

A unique digital card experience

Provide a fully digital and unified card experience to your customers. Bring convenient instant digital card services

Leading innovations for bank apps

Offer latest digital card features and innovations directly in your mobile banking application

Simplified integration

One single SDK integration to support all digital card use cases with unique security. Also available via web-service based integration.

Complementary or stand-alone

Upgrade your existing bank app and card portfolio with our Digital Card SDK, or via a web-service based integration. But also build new Digital Card programs for your customers with all-in-one solution

Key features

Pay by account

Enable digital account-based payments, no card issuance required.

NFC issuer wallet

Enable tap-and-pay directly from your branded banking app.

Push to wallets

Seamlessly provision cards into Apple Pay, Google Pay, Samsung Pay, and Click to Pay.

iTSP

Unified hub for token provisioning and management across schemes.

Entrust Click to Pay

Auto enrollment and lifecycle control with secure, tokenized checkout for future proof payments

Resources

CreditBank PNG partners with Entrust to deliver digital-first banking experience in Papua New Guinea

Unlock Click to Pay across APAC with mastercard and Entrust

Entrust Digital Card Solution

Request a demo

A fully customisable banking platform

Pannovate is an orchestration layer and Banking-as-a-Service enabler, with 150 APIs and a network of 47 truly agnostic vendors from processors to KYC providers and BIN sponsors.

Our platform and orchestration layer are used by many for wallet management, payment processing, and card issuing. You can gain access to Pannovate’s modular solutions to create your value proposition cost-effectively and launch to market in record time.

Overview

Syllo

You design the ecosystem. Add and switch suppliers as your product evolves. Plug in different third-party suppliers or use your existing suppliers.

Launchpad

LaunchPad offers an out-of-the-box mobile and web app and integrates all third-party suppliers required for a programme to launch, from ppliers to processors.

Launchpad Lite

Launchpad Lite offers the full range of expected features with a customisable user interface enabling you to create a unique omni-channel value proposition, in just 6 weeks.

Platform Benefits

Build your product on a modern platform.

Test on 150 APIs

Launch within 12-16 weeks

A network of 47 agnostic partners across geographies

Scale seamlessly into multiple regions

Add any functionality quickly and cost-effectively to create a value proposition via a range of value add solutions and pre-approved providers

Bankvault

Bankvault is Pannovate’s analytics suite and provides a detailed insight into your product performance and customer activity and behaviour in real-time.

Resources

Overview

Request A Demo

Standard Chartered

Powering FX capabilities for financial institutions.

From international corporate banks needing to access specific markets, to digital-first banks and retail banks managing remittances, Standard Chartered Aggregated Liquidity Engine (SCALE) on Temenos provides comprehensive FX-solution coverage.

Gain fast-to-market access to our FX capabilities, with fewer technology-resource requirements. Plus, the option to combine with Temenos Payment Hub enables you to consolidate SCALE with payment rails worldwide, on a single platform.

Meet all your FX needs with a wide variety of capabilities and unrivalled currency options.

Get started fast, go to market faster: Save time and resources with this integration and meet your clients’ FX needs faster.

Reach new and emerging markets: A world of G10, emerging and frontier FX opportunities awaits, all via a single point of access.

Optimise your FX risk management: Manage volatility exposure via SCALE’s rate-holding options.

For financial institutions to unlock new markets and growth

Corporate Banks

Automation is typically the key to unlocking efficiencies in FX execution, yet embedding relevant solutions can be resource draining. Get in touch to learn how SCALE can help.

Retail Banks and Wealth Managers

As cross-currency payments and investment accelerate, offer your customers the best in FX capabilities for low-value, high-volume transactions. Get in touch to learn how SCALE can help.

Request a demo

Marqeta’s platform provides innovators with the freedom to create bespoke card programs.

Marqeta is the first global modern card issuing platform, providing advanced infrastructure and tools for building highly configurable payment cards. With its open API, the Marqeta platform is designed for businesses who want a simple and tailored way of managing payment programs so that they can create world-class experiences and power new modes of commerce.

Overview

Speed

Respond to changing customer demands by being able to build card programs in days not months.

Iterate

On your own terms without incurring professional service fees with API access to the processing platform; launch new card features, issue new card types and launch in new countries.

Scale

Proven platform processing billions of transactions globally.

Reach

One global platform avoids the need for multiple regional integrations with processors providing resource and time efficiencies.