Modernization with Purpose

Simpler, seamless, engaging: the future of New Zealand banking

New Zealand Banks are Opening Up for Transformation

The global pandemic has accelerated changes that would happened anyway including moves to a more digital economy, cashless-payment and branch closures.

One global report estimates that the lockdowns meant we progressed 5 years in consumer and business digital adoption in 8 weeks.

KPMG, New Zealand FIPS Quarterly Results, March 2021

Aside from the need that all banks must reimagine their digital banking model & operation to meet changing customer expectations, New Zealand banks are also facing challenges like:

- Cost pressure by increased regulation and compliance requirements

- Siloed digital customer experience on multiple channels

- System unable to scale fast during sudden surge of new digital users or new account opening

- Complexity in new product innovation due to the legacy core

- Foreseen future competition from new digital players

How Can We Prepare You for the Future Game

Reimagine Digital Banking Experience in the New Normal

With more New Zealanders adopt digital as the default banking channel, its even more critical for banks to provide seamless, engaging omnichannel experience.

With Temenos Infinity, new customers can self-serve onboard with their mobile in minutes. Banks now can provide hyper-personalized products by embedded analytics and engage with customers in real-time.

Always be there when your bank customers in need.

Simpler, Faster and Cheaper Operation with a Modern Core

Years of legacy system is hauling banks back in new products innovation, complex loan approval process and new compliance requirement.

It’s time for modernization especially when new players are in the digital game.

Temenos Transact is the most successful and widely used digital core-banking solution in the world. The latest core banking technology allow banks to simplify their operations and innovate faster & smarter with lower Total Cost of Ownership.

Scale at Hyper-efficient Cost Model with Cloud

Temenos cloud-native and cloud-agnostic solutions allow you to elastically scale on-demand with security and agility.

Temenos Banking Cloud, combining the richest banking services, sandbox, plug & play Marketplace and AI functionalities, enable banks to innovate new product faster and extend business to new segments at super cost-efficient model.

Temenos are available across all major public clouds: Microsoft Azure, Google Cloud, AWS.

Seize Open Banking & Ecosystem Opportunities

The increasing scope and competition in the banking ecosystem that open banking enables have led to both new opportunities and new challenges for financial institutions.

Temenos technology run natively on all major cloud platforms, exposes an extensive set of open APIs and allows easy integration to any third party systems.

Code in the Morning, Deploy in the Afternoon with DevOps

Continuous upgrades are a core tenet of cloud utilization. DevOps teams delivering on the continuous integration and continuous story are able to expedite project delivery timelines through self-service and self-management environments and tools, controlling the pace with which development plans progress, from configuration to full test.

Temenos Continuous Deployment Fast Track provides your teams with the ability to manage, configure and assemble your licensed Temenos software, fully deployed and supported by Temenos SaaS.

The World’s #1 Banking Solution

Hear From Our Winning Customers

You’re in Good Company

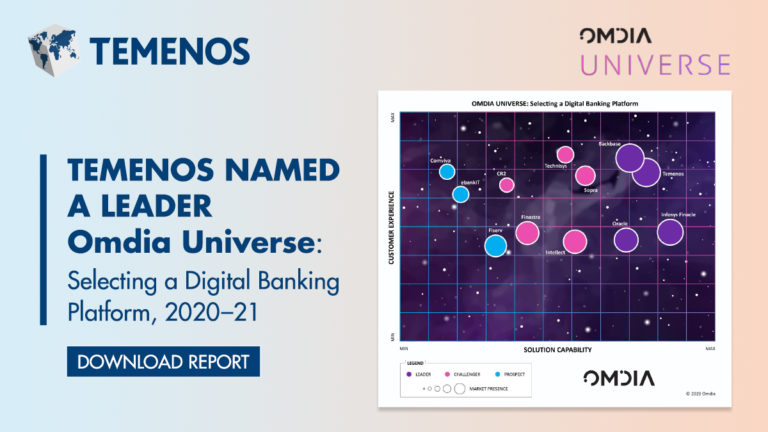

Recognized as Leader by Global Analysts

More About Temenos Solution

Talk to us today

Thank you for your interest. Register below and our dedicated consultants will reach out to you within the next working day.