Upscale Your Investor Servicing for Alternatives and Private Equity

Temenos Multifonds Investor Servicing solution is designed to support large volumes and scale effortlessly as your business grows. Reimagine your future investment journey that is seamless and fully automated.

Scale, Volume and Liquidity Benefits in the Alternatives and Private Equity World

As we observe the retailisation and democratisation of Private Equity, there will be an inevitable surge of investors in the Alternative space. How can Private Equity firms and Fund Administrators meet the expectations of retail investors to provide a seamless onboarding journey, while keeping a good margin with high operational efficiency?

Imagine onboarding an unlimited number of investors with sophisticated KYC and AML frameworks, whilst managing your traditional and alternative funds all together on a hybrid, global platform.

Meet the Temenos Multifonds Investor Servicing Solution to shape your future investment journey. #InvestmentOperations Deserve Modern Technology.

Hear from the expert

Are you ready for ELTIF 2.0?

1. What are the benefits key benefits for managers?

2. What are the operational challenges?

3. How can Multifonds help?

Multifonds Investor Servicing Solution

Streamline the distribution chain by digitizing the onboarding process with a modern technology platform. Leveraging our sophisticated Investor Servicing app and API integration to find new efficiencies and reduce risk.

A modern digital experience for the full investment lifecycle

To support global operating models, not only for core functions of investor record keeping, but also for administration processes for the full investment lifecycle : investor due diligence, cash management, distribution fees and retrocessions, performance fees, data protection and tax.

Hybrid structure – supporting traditional and alternatives on a single, global platform

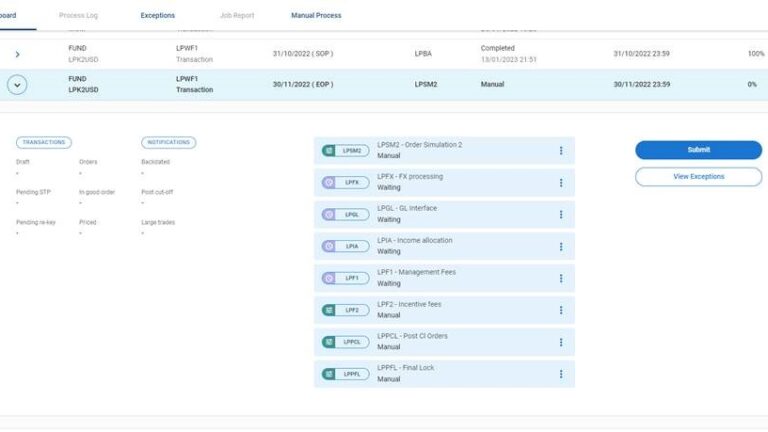

Support for closed-ended fund structures through commitment tracking, with capital calls, drawdowns, distributions and fees processing.

Embedded liquidity management features for hybrid funds, including redemption gating, fund lock-ups, side pockets, and other flexible transaction level controls.

Limited Partnership accounting via business-rule driven income allocations, asset-based fees, incentive fees and performance return calculations.

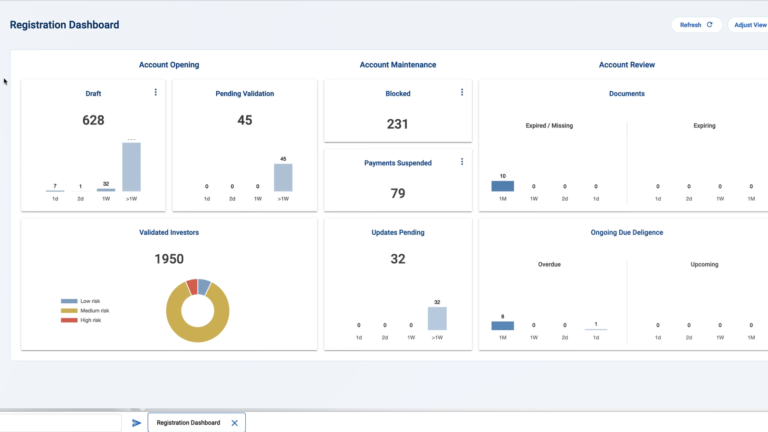

Simplify investor registration & due diligence

Integrated and sophisticated KYC and AML frameworks guide users through the requirements for appropriate due diligence, not only at registration, but throughout the lifespan of an investor’s holding.

API-first architecture allows easy integration with back-office and 3rd party applications.

Driving ultimate operational efficiency through enhanced automation

Integrated workflow, controls and exception management frameworks to enhance automation and oversee your operations through an exception-based processing model.

Customisable Reporting solution for the dissemination of capital account, call and distribution notices, commitment acknowledgement and investor communications.

Trusted by Global Top Fund Administrators and Asset Managers

Measurable success

9 of the top 15

global fund administrators supported

30+ countries

30000+ funds

supported

$10 trillion

assets supported

Talk to us

Thank you for your interest, our dedicated consultants will be in touch soon.