Upscaling Nordic Asset Servicing Operations

Temenos Multifonds is an Explainable AI-enabled exception-driven processing system, designed to assist fund administrators and asset managers in achieving ultimate operational efficiency while reducing risks.

Step towards a more reliable and sustainable future

Nordic asset servicing companies hold a unique advantage in spearheading the global push towards sustainable investment trends.

The escalating discourse on ESG investments and the transition to net-zero is of paramount importance. It’s a prime time for Nordic firms to capture new opportunities, building on existing assets to capitalize on new green value pools.

Simultaneously, the ascent of Private Equity retailisation, coupled with the forthcoming impact of the ELTIF2.0 regulation in Europe (effective 2024), enables traditional and private managers to embrace the extensive potential brought by incoming retail investors.

To harness and rapidly expand upon these opportunities over the next 3-5 years, a notable trend is emerging: Nordic asset servicing firms are increasingly turning to modern technology to scale their business. This surge in adoption is propelled by the growing digitalization of asset management processes and a compelling need for solutions that enhance financial efficiency, optimize operations, and drive customer satisfaction. According to the EY Norwegian Enterprise Asset Management Survey 2021, approximately one-third of organizations are planning major Enterprise application or software reviews and upgrades within the next year. Moreover, an additional 24% of respondents anticipate doing so within one to two years.

Are you ready to grow with these changes?

Upscale and bring new services to market faster with Multifonds

Nordea Investment Funds

– The largest asset manager in the Nordics is using Temenos Multifonds to administer €100+ bn in assets

– Nordea looked to enhance its suite of services to attract new business.

– To achieve its growth targets, Nordea aimed to modernize the technology underpinning its operations, improving efficiency and asset servicing.

-Nordea selected Multifonds to consolidate its multiple on-premises systems into a modern cloud-based asset management platform. To fuel its expansion in Luxembourg, improving client services and streamline internal processes.

-Nordea is benefited from the flexible retrocession and accrual calculation functionality, and fully integrated SWIFT connectivity to support secure international funds transfers.

“At Nordea Investment Funds, we are committed to our clients’ success with services and solutions that adapt to their evolving needs. Improving our technology infrastructure with key partners such as Temenos is core to this strategy. Temenos’ open technology, built on cloud-native components, will allow us to bring new services to market faster to enhance the client experience and scale efficiently to support increased volumes.”

Markku Kotisalo, Head of Fund Administration, Nordea Investment Funds

Multifonds Investor Servicing & Transfer Agency

Support both traditional and alternative fund types on a single, global, SaaS- ready platform

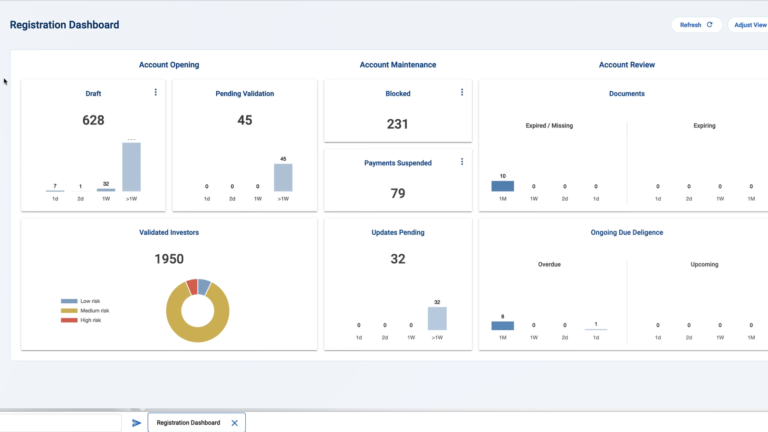

Streamline the distribution chain by digitizing the onboarding process with a modern technology platform. Leveraging our sophisticated Investor Servicing app and API integration and benefiting from SWIFT and NSCC connectivity with counterparties.

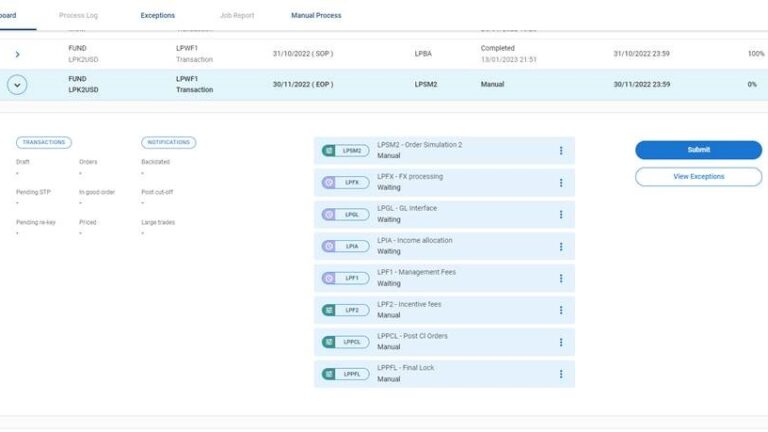

Drive efficiency with exception-based workflow

Integrated workflow, controls and exception management frameworks to enhance automation and oversee your operations through an exception-based processing model.

The role-based dashboard helps oversee the full investment lifecycle for traditional and alternative funds, from receiving electronic order instructions, to cash management, dealing and pricing.

Capability to onboard an unlimited number of investors

Integrated and sophisticated KYC and AML frameworks guide users through the requirements for appropriate due diligence, not only at registration, but throughout the lifespan of an investor’s holding.

API-first architecture allows easy integration with back-office and 3rd party applications.

Trusted by Global Tier 1 Asset Servicers

Measurable success

9 of the top 15

global fund administrators supported

30+ countries

30000+ funds

supported

$10 trillion

assets supported

Book a demo

Thank you for your interest, our dedicated consultants will be in touch soon.