Temenos Multifonds Navigator

Reimagine your NAV oversight and contingency process with Navigator

Smarter & easier contingent capability that’s cost-efficient & future-fit

What is Multifonds Navigator?

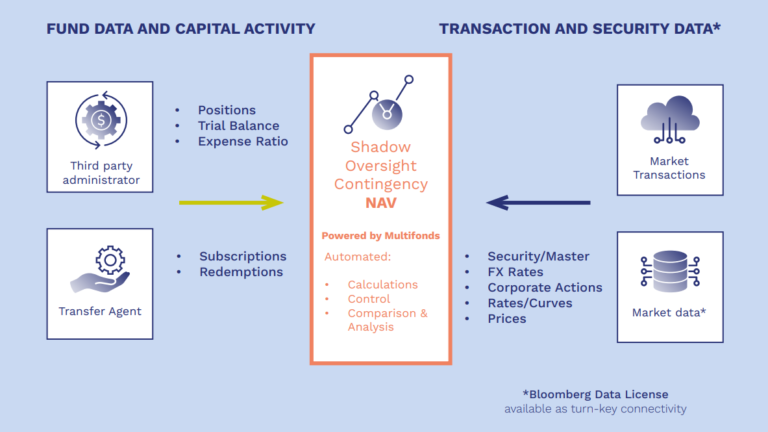

Temenos Multifonds Navigator is a modern NAV shadow, oversight and contingency solution designed for asset managers, insurance firms and pension funds.

Ensures contingent NAV capability in the event of unexpected fund administrator outages/downtime. An intuitive and adaptable solution that is future-fit, allowing you to quickly respond to any potential regulatory requirement or industry-related changes.

- A single, global solution on SaaS, available remotely through the web

- Independent of your primary fund administrator

- Automated, exception-driven workflow with pre-defined controls

- A dashboard view with automate reconciliation to show NAV divergence

NAV Oversight & Contingency Made Easy

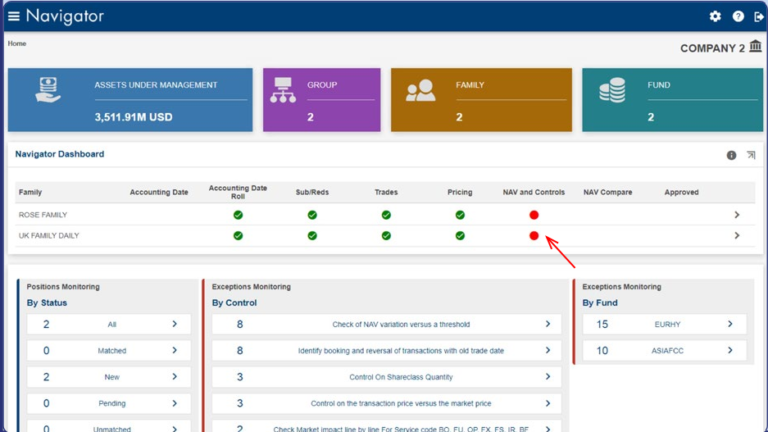

A Dashboard View Across All Fund Processes

The dashboard gives you a bird’s eye-view across all your funds, to quickly identify where funds are in the NAV process and highlights exceptions impacting your funds’ NAV calculations.

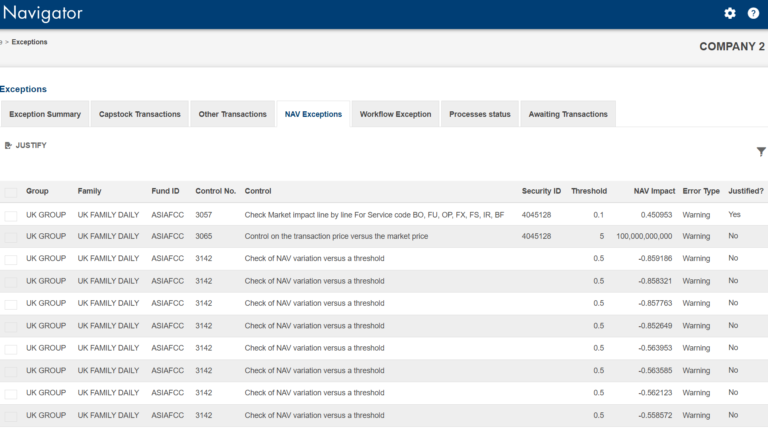

Streamline with Exception-based Workflow and Pre-defined Controls

Navigator leverages the power of Multifonds exception-based workflow with over 250 exception-raising, pre-defined controls that can be adjusted based on fund group, fund, asset class, currency, and domicile.

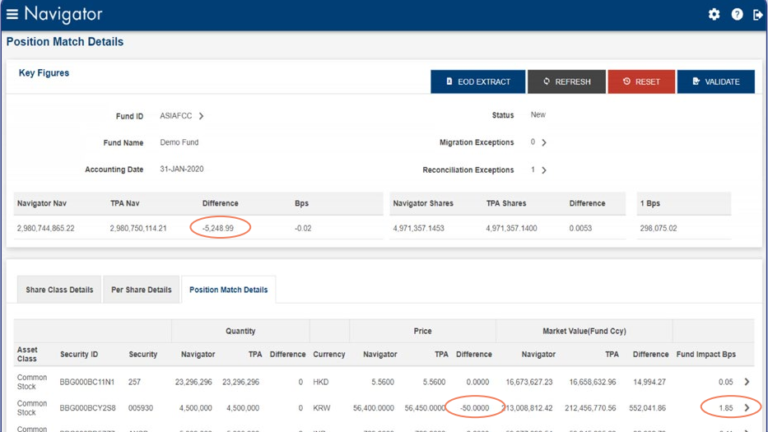

Automated Reconciliation to Highlight NAV Divergence

Providing a comparison to the official, fund administrator NAV. Navigator allows for automated reconciliation by highlighting where differences lie, allowing users to drill down into problem areas quickly.

Meet Deadlines with Independent NAV Calculations

Navigator’s workflow and automation is designed to calculate NAVs well ahead of the Fund Administrator’s calculation to support pre-release review of the NAV, where desired or required.

Easily integrated with global and local market data providers, such as Bloomberg, through sophisticated API-first architecture.

A Single, Global Platform on SaaS

Modernize fragmented, legacy systems across different regions. SaaS solution available remotely through the web, with an intuitive, modern user interface.

Measurable Success

30000+

Funds

35

Jurisdictions

$10tn

Assets supported

9 out of top 15

global fund administrators supported

You’re in good company

Download Factsheet

Thank you for your interest, our dedicated consultants will get in touch with you very soon!