Unveil Hidden Issues, Manage Regulatory Requirements, and Harness Data to Drive Business Opportunties

Changing the complaints management paradigm in banking.

For all financial institutions (FIs), complaints are an incredibly important but sometimes underappreciated aspect of the customer experience. While some view complaints management largely as a check-the-box activity, others actively embrace it as an avenue for continuous improvement and innovation. How well a FI anticipates, responds to, and applies insights from complaints plays a pivotal role in their ability to solidify customer relationships and stand apart from competitors. So how do organizations move from apathy to appreciation and value creation when it comes to complaints management?

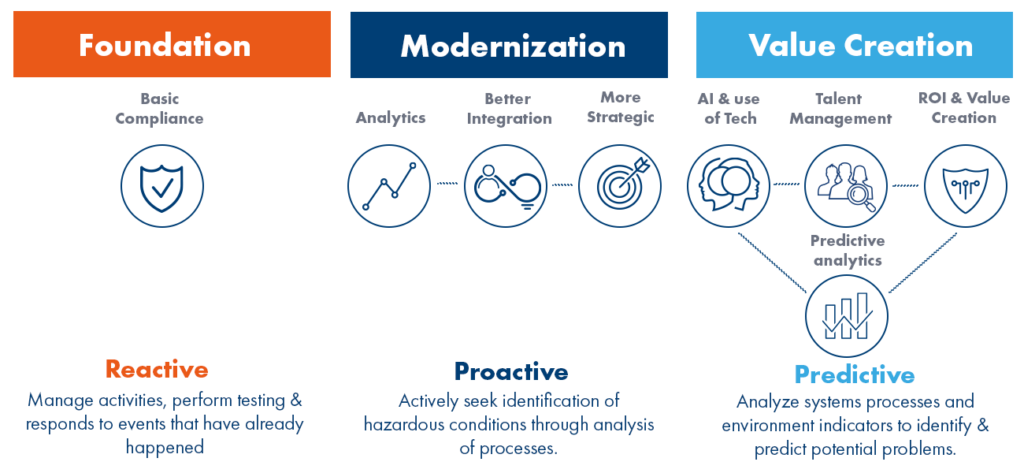

Complaints and Compliance Management Maturity

Regardless of where an organization is on the spectrum of complaints and compliance management maturity, there is always room to improve. At one end are foundational approaches that tend to be more reactive and marked by managing activities, selective testing, and responding to events that have already happened. Modernizing this approach brings better integration of people, processes, and technology along with analytics and strategic elements to seek out hazardous conditions more actively. FIs that are going even further to create real value from complaints and compliance management are leveraging AI and advanced technologies as well as focusing on talent management to identify and predict potential problems before they surface.

Customer Expectations and Experiences

Donald Porter, former VP of British Airways, was famously quoted as saying, “Customers don’t expect you to be perfect. They DO expect you to fix things when they go wrong.” Fulfilling this expectation and handling complaints in a way that builds on relationships rather than weakens them entails:

- Easy and Intuitive Access – Provide customers friction-free and straightforward avenues for voicing complaints via multiple channels.

- Clear and Timely Communication – Deliver the right mix of messages and notifications that provide status updates, next steps, and answers to anticipated questions.

- Responsibility & Accountability – Make sure each customer knows that your team’s primary mission is to provide them with answers and assistance.

- Empathy – Recognize and acknowledge the impact or inconvenience that each customer is experiencing.

- Positive Resolution – Be seen as a problem solver and ensure that each customer’s questions are answered and understood.

The way companies handle complaints can be the difference between success and failure. FIs with complaint management programs that genuinely treat customers how they wish to be treated and actively look for opportunities to improve will increase loyalty, strengthen customer bonds, and differentiate themselves positively.

The Recipe for Effective Complaint Management

Putting the bullets above into practice with every complaint requires the right mix of three central ingredients – people, processes, and technology. Any weak link along this chain can and usually will degrade the other components’ ability to support successful outcomes.

The people that represent FIs in complaint interactions not only need comprehensive onboarding training but also ongoing training that ensures they remain up to speed on key trends, regulations, and process steps. Additionally, these employees must be empowered to resolve issues confidently when unclear areas or elevated customer frustrations arise. Supervisors must also support their complaints management teams with ongoing coaching that examines different scenarios and paths and ensures that empathy and customer-focused care are being demonstrated at all times.

Complaint and compliance management processes are comprised of several essential elements – risk assessment that defines high-risk regulations (e.g., fair lending) and high-risk customers, thorough policies and procedures for response and escalation, root cause analysis to find and fix systemic failures, monitoring and tracking, extensive testing, and streamlined internal communication channels. Some FIs have even elected to publish their complaint management programs publicly for complete transparency. Many also seek out partners with the regulatory bodies that govern them as well as with consumer advocacy groups to identify focal points and collaborative solutions.

The technology that supports compliance and complaint management programs is becoming an increasingly powerful lever for FIs. Organizations are rapidly reducing the array of spreadsheets and mostly manual tasks that were hallmarks of traditional programs. Replacing or augmenting them are centralized software and technology solutions that enable consistent and complete logging, clear complaint taxonomies spanning all channels, significant automation and efficiencies, and added supports for decision making, communication, and escalation across the full lifecycle of complaints. Consistent and reliably captured data then sets the stage for robust reporting, deep analysis, and, with some technologies, AI-enabled insights for a holistic view of where complaints are stemming from, how well the organization and its respective teams are managing them, and where improvements are needed most.

Viewing Complaints in a Value Creation Light

Financial institutions that enable and ensure effective compliance and complaints management programs will in virtually every case be rewarded with increases in revenue, closer customer relationships, improved Net Promoter Scores, higher wallet share, and positive differentiation from competitors. It’s time to lose the lens that casts complaints as ever-present evils and see them instead as prime opportunities to make banking better.

View the webinar “How Complaints Drive Innovation – with Temenos and 360factors”, featuring Greg Sawyers, here.

About 360factors

360factors empowers organizations to accelerate productivity, innovation and profitability by predicting risks and streamlining compliance. 360factors is the exclusive endorsed solution provider for risk and compliance management software by the American Bankers Association (ABA). Visit www.360factors.com to learn more.

About Temenos

Temenos offers cloud-native, cloud-agnostic, API-first digital banking, core banking, payments, fund management, and wealth management software products, enabling banks to deliver consistent, frictionless customer journeys and achieve market-leading cost/income performance. Over 3,000 firms across the globe, including 41 of the world’s top 50 banks, rely on Temenos to process the client interactions and daily transactions of more than 1.2 billion banking customers.