Temenos Pre-Announces a Strong End to the Year With a Further Sequential Improvement in Software Licensing; Delivering FY20 SAAS ACV Growth of 65%, FY20 SAAS Revenue Growth of 44% and FY20 Recurring Revenue Growth of 13%

GENEVA, Switzerland, January 13, 2021 – After an initial review of its fourth quarter and full year 2020 performance, Temenos AG (SIX: TEMN), the banking software company, today reports its preliminary fourth quarter and full year 2020 results.

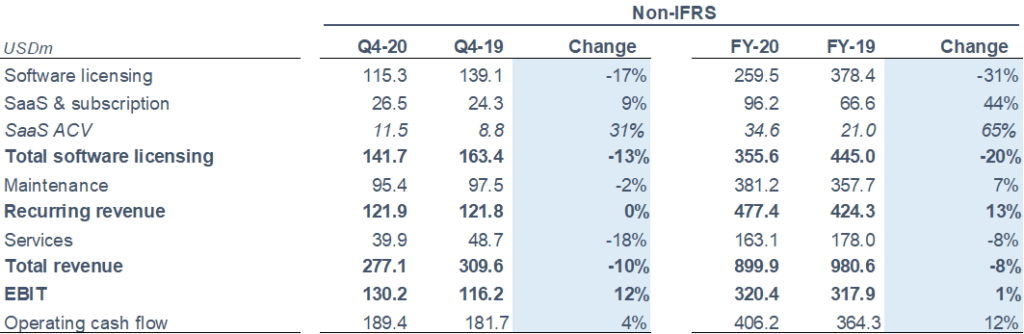

The definition of non-IFRS adjustments is below. Growth rates are reported. Recurring revenue is SaaS and Maintenance revenue combined.

Q4 and FY 2020 financial summary (non-IFRS)

- SaaS Annual Contract Value (ACV) up 31% in Q4 20 and 65% in FY 20

- Non-IFRS SaaS & subscription revenue growth of 9% in Q4 20 and 44% in FY 20

- Non-IFRS total software licensing revenues down 13% in Q4 20 and down 20% in FY 20

- Non-IFRS recurring revenue growth of 0% in Q4 20 and 13% in FY 20

- Non-IFRS total revenue down 10% in Q4 20 and 8% in FY 20

- Non-IFRS EBIT growth of 12% in Q4 20 and 1% in FY 20

- Operating cash flow growth of 4% in Q4 20 and 12% in FY 20

Commenting on the results, Temenos CEO Max Chuard said:

“The sequential improvement we saw in Q3 continued strongly in the fourth quarter, with our sales closure rates improving in particular in Europe, and the predictability of our business and the velocity of pipeline conversion reaching near pre-Covid levels. Banks across all tiers and geographies returned to conducting significant strategic transformation projects with large banks executing license deals and neo-banks and smaller institutions moving to a SaaS model. Our recurring revenue grew 13% in 2020, driven by our strong growth in SaaS revenue as well as our resilient maintenance base, which also drove strong growth in operating cash flow of 12%. We have seen a sequential improvement in software licensing and an accelerating demand for SaaS and cloud, with the majority being largely incremental, in particular from smaller and mid-size banks as well as neo-banks and new entrants. Our flexible cost base ensured we were able to protect our profitability whilst continuing to invest in the business, in particular in R&D and key sales positions during a challenging year. Based on the evolution of the business in Q4 and our pipeline, we are very well positioned for this year and beyond, and remain very confident in returning to double-digit Total Software Licensing growth in 2021, driven by both SaaS growth of 30% and strong Software Licensing growth.”

Additional information

This press release and all information herein is preliminary and unaudited.

Fourth quarter and full year 2020 results announcement

Temenos’ fourth quarter and full year 2020 results will be announced on Wednesday 17th February after market close.

Webcast following fourth quarter and full year 2020 results announcement

At 18.00 CET / 17.00 GMT / 12.00 EST, on Wednesday 17th February, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. Please register for the webcast using the following link:

Q4 and FY 2020 webcast registration link

Capital Markets Day

Temenos will host a virtual Capital Markets Day on Thursday 18th February in the afternoon (CET). Please register for the Capital Markets Day using the following link:

Capital Markets Day registration link

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Other definitions SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements. Recurring revenue includes Maintenance and SaaS & subscription revenue combined.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]