World Economic Forum in China champions digital ecosystems

China is on course to overtake Silicon Valley as the dynamo of tech development… if it hasn’t done so already.

The World Economic Forum’s Annual Meeting of New Champions in China last month was a showcase for this colossal effort. From the massive, high-spec conference centre that hosted the event in Tianjin, built in just eight months, to the super-platform companies Baidu, Alibaba and Tencent – the oldest being less than 20 years old, the youngest less than 10 – everything smacked of speed and progress.

Data rules

In banking terms, the effects are dramatic. Mobile payments in China have exploded. Last year, in the 10 months to October, they reached US$12.8 trillion in value – whereas the US spent an estimated US$49.3 billion via mobile apps.

Alibaba-owned Ant Financial alone processes 125,000 transactions per second on average, with fraud and risk completely managed by artificial intelligence and machine learning. In November 2017, it processed a record US$8bn in the first hour of Singles Day. That’s incredible. To give it some context Visa processes around 2,000 transactions per second.

But it’s not just transactions. The super-platform companies are quickly pushing deeper into people’s lives, collecting and using data to help better understand their customers.

For example, TenCent’s WeChat achieved the milestone of 1bn active users earlier this year. Not only do they pay for goods and services that way, but they live their lives through the app – from booking a doctor’s appointment or hiring a taxi to ordering a takeaway and using social media to tell friends all about what they are doing. This gives Tencent huge insight into its users’ lives and the lives of their friends. It is revolutionising the way consumers interact with each other and with commerce. Nor is Tencent standing still – it has its sights set on international expansion and is expected to receive a banking licence for Hong Kong before the year is out.

In Tianjin, we heard that all this is putting huge pressure on banks to transform quickly to stay in the game. Where in the US and Europe, customers still use cheques and cards, in China it’s all about smartphones and the super-platform companies’ payment apps. Banks have relationships with the platform companies, but it’s the latter that own the data.

Data is the key. It will be data that allows companies – be they platform companies, merchants or banks – to know their customers, anticipate what they want, and develop and deliver it efficiently. AI is going to be hugely important in this.

Digital innovation

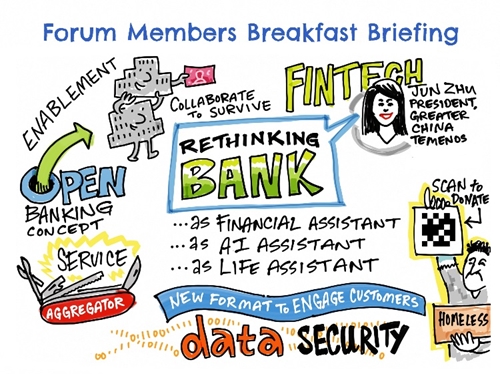

For banks this means going digital to the core to allow them to develop new products at speed, keep costs down, gather and analyse data, and develop the AI applications that will get them closer to their customers. But they can’t do all this on their own. They need partners.

Increasingly banks, small and large, realise they need to create their own ecosystems. Shanghai Pudong Development Bank (SPD Bank), for example, is the world’s 17th largest. Even a bank of this size believes it needs to forge dynamic partnerships in order to become more like a technology company.

It has chosen Temenos as a strategic banking-software partner, gaining access to our MarketPlace, one of the world’s largest fintech and regtech markets. But the bank is not just looking to established companies. It is also seeking out and hoping to develop nascent fintechs.

Next month SPD Bank is holding its first Innovation Jam in Shanghai to identify domestic and international fintech talent. Five fintechs from our own MarketPlace are already on the bill. The most promising will be invited to join a new joint Innovation Lab – with Temenos – where fintech solutions can be tested in real-life situations to hone them faster and more efficiently. It may be a different way of thinking for banks, but for us thinking differently is one of our founding principles.

Beyond this joint venture, Temenos was also actively involved in furthering the financial and banking agenda at the WEF, encouraging start-ups, championing banking inclusion and looking at ways to foster innovation.

Given the size of the market and the competition from platform companies, the drive to innovate, think differently and be different is powerful. Together with China’s huge pool of talent, a government that sees the development of new technology as a key policy and deep pockets, China shows no sign of slowing down. If anything from what I saw at WEF Tianjin, the pace of innovation looks set to gather speed.

Carl Robertson is chief marketing officer at Temenos