Temenos Announces Outstanding Q2 With Total Software Licensing Revenues up 25%

GENEVA, Switzerland, 20 July 2016 – Temenos Group AG (SIX: TEMN), the market leading provider of mission-critical software to financial institutions globally, today reports its second quarter 2016 results

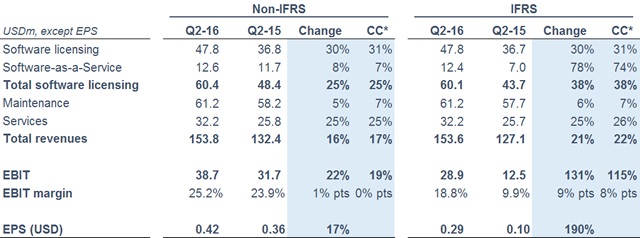

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q2 2016 Highlights

- Outstanding performance across all KPIs

- Total software licensing up 25% for the quarter, driven by strong license growth of 31% y-o-y

- Digitisation and cost focus continue to drive bank decision making

- Leadership in Wealth with signing of Standard Chartered Bank and Banque Internationale à Luxembourg (BIL)

- Leadership in Retail with signing of Laurentian Bank and BIL

- Strong start to Q3 resulting in record level of revenue visibility for Q3 and FY 2016

- Very strong pipeline, significant breadth and depth of deals

- Expect to achieve high end of FY 2016 guidance

Q2 2016 Financial Summary

- Non-IFRS total software licensing up 25% (c.c.) and IFRS total software licensing up 38% (c.c.) Y-o-Y

- Non-IFRS maintenance growth of 7% (c.c.) and IFRS maintenance growth of 7% (c.c.) Y-o-Y

- Non-IFRS EBIT up 19% (c.c.) and IFRS EBIT up 115% (c.c.) Y-o-Y

- Non-IFRS EPS increase of 17% and IFRS EPS increase of 190% Y-o-Y

- Q2 2016 LTM cash conversion of 130%

- DSOs down 46 days Y-o-Y

Commenting on the results, Temenos CEO David Arnott said:

“Q2 has been an excellent quarter on the back of a strong Q1, and the business continues to perform well across all KPIs. The level of sales activity has remained very high, particularly in Developed Markets, and we have seen banks across all tiers and segments commencing significant IT renovation projects. I am particularly pleased with the continued growth in revenues from Tier 1 and 2 clients, which demonstrates the scalability of the product and the traction we have with the world’s largest banks.

We signed a number of highly strategic deals, most notably Standard Chartered Bank, Laurentian Bank and Banque Internationale à Luxembourg, and we continue to take market share in a growing market. The structural pressures of digitisation and cost focus mean banks are continuing to press ahead with upgrading their IT platforms. In particular, we have a win rate of nearly 100% in Wealth with multiple key deals signed in the last 18 months and have signed 2 of the largest Retail deals in the market in the last 12 months.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“I am very pleased with our performance this quarter, with strong growth in both revenues and profitability. With strong levels of upfront license collection and good progress on a number of implementations, cash collection was exceptionally high in Q2. This was reflected in our DSOs, which ended the quarter at 130 days, a reduction of 46 days year-on-year. With record levels of revenue visibility for Q3 and FY 2016 and a very strong pipeline, we are confident in achieving the high end of our 2016 guidance.”

Revenue

IFRS revenue for the quarter was USD 153.6m, up from USD 127.1m in Q2 2015. Non-IFRS revenue was USD 153.8m for the quarter, up from USD 132.4m in Q2 2015, representing an increase of 17% in constant currencies. IFRS total software licensing revenue for the quarter was USD 60.1m, and non-IFRS total software licensing revenue for the quarter was USD 60.4m, an increase 25% from Q2 2015 in constant currencies.

EBIT

IFRS EBIT was USD 28.9m this quarter. Non-IFRS EBIT was USD 38.7m in Q2 2016, 19% higher than in Q2 2015 in constant currencies, with a Q2 2016 non-IFRS EBIT margin of 25.2%, up 1% points on Q2 2015.

Earnings per Share (EPS)

IFRS EPS for the quarter was USD 0.29 vs. USD 0.10 in Q2 2015. Non-IFRS EPS was 0.42 for the quarter vs. USD 0.36 in Q2 2015, an increase of 17%.

Pre-Tax Operating Cash

IFRS operating cash was an inflow of USD 37.7m in Q2 2016 compared to USD 19.2m in Q2 2015. For LTM to June 2016, operating cash was USD 259.5m representing a conversion of 130% of IFRS EBITDA into operating cash.

2016 Guidance

The company reconfirms its outlook for the year as follows*:

- Non-IFRS total software licensing growth at constant currencies of 10% to 15% (implying non-IFRS total software licensing revenue of USD 233m to USD 244m)

- Non-IFRS revenue growth at constant currencies of 7.5% to 11.0% (implying non-IFRS revenue of USD 593m to USD 612m)

- Non-IFRS EBIT at constant currencies of USD 180m to 185m (implying non-IFRS EBIT margin of c.30%)

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 17% to 18%

*Assumes FX rates as disclosed in Q2 2016 results presentation – https://www.temenos.com/en/about-temenos/investor-relations)

Conference call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 20 July 2016, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 828 006 (Swiss Free Call)

1 866 966 9439 (USA Free Call)

0800 694 0257 (UK Free Call)

+44 (0) 1452 555 566 (UK and International)

Conference ID # 48545519

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2016 non-IFRS guidance:

- FY 2016 estimated amortisation of acquired intangibles of USD 35m

- FY 2016 estimated restructuring costs of USD 4m

Restructuring costs include completion of Multifonds integration and realising R&D efficiencies in acquired products. These estimates do not include impact of any further acquisitions or restructuring programmes commenced after 20 July 2016.

The above figures are estimates only and may deviate from expected amounts.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]