Temenos Delivers Strong Results Across All Metrics and Reaffirms Full Year Guidance

GENEVA, Switzerland, 29 July 2013 – Temenos Group AG (SIX: TEMN), the market leading provider of mission-critical software to financial institutions globally, today reports its second quarter 2013 results.

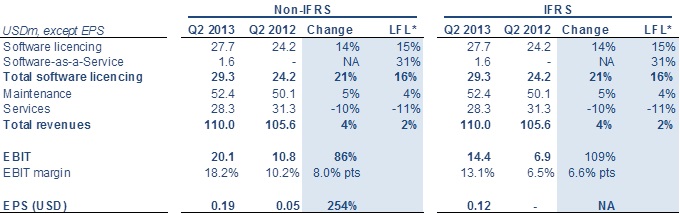

A full reconciliation of IFRS to non-IFRS results can be found in Appendix II

* Like-for-like (LFL) excludes contributions from acquisitions and adjusts for movements in currencies

** Earnings before interest, tax, depreciation and amortisation (EBITDA) into cash generated from operations

- Like-for-like licence growth of 15% (14% reported), the third consecutive quarter of growth

- 7 new customer wins including important strategic wins in Asia; continuing to take market share

- 4% pts improvement in non-IFRS services margin

- Like-for-like non-IFRS costs down 7% (IFRS costs down 3%) with non-IFRS EBIT margin up 8% pts

- Non-IFRS EBIT up 86% with IFRS EBIT more than doubling

- Cash conversion** of 132% in the twelve months ending June 2013

- Initiated share buyback with USD 12.4m returned up to end of June 2013

- Remain on track to deliver reaffirmed 2013 guidance

Commenting on the results, Temenos CEO David Arnott said:

Our strong performance in Q2 reflects the changes we have made to the business over the last 12 months. The organisation has been delayered and our strategic priorities have been made clear. As a consequence, we are executing much better across the business, extending our product leadership and generating greater levels of customer success. We have now delivered three consecutive quarters of licence growth in a market that is still challenging, underlining market share gains, and we remain on course to deliver our guidance for the full year.

Looking forward, I remain confident in our ability to capture the significant market opportunity that exists as financial institutions continue to switch IT spending to third parties. Our product suite is functionally rich, packaged and upgradable, and is proven to deliver the highest levels of customer success in the industry. We also now offer our products on a hosted, SaaS basis as well as through the cloud, which positions us extremely well as financial institutions change the way they consume mission critical applications, a trend we see accelerating. Lastly, we are making significant progress with our partners, broadening their role to encompass sales as well as delivery, which we see as key to scaling our organisation to meet the growing demand for system renewal.

Revenue

Both IFRS and non-IFRS revenue for the quarter was USD 110.0m, up from USD 105.6m in Q2 last year, representing an increase of 4%. Software licence revenue for the quarter was USD 27.7m, 14% higher than in the same period in 2012 on a reported basis.

EBIT

Non-IFRS EBIT was USD 20.1m in Q2, 86% higher than in Q2 2012, with a non-IFRS EBIT margin in Q2 of 18.2%, up 8% points on 2012. IFRS EBIT more than doubled from USD 6.9m in Q2 2012 to USD 14.4m in Q2 2013.

Earnings per Share (EPS)

Non-IFRS EPS was USD 0.19 in the quarter, compared to USD 0.05 in the prior year. For the twelve months to June 2013, non-IFRS EPS was USD 1.14, almost doubling from USD 0.61 in 2012. IFRS EPS for the quarter moved from zero to profit per share of USD 0.12.

Pre-Tax Operating Cash

Operating cash was an inflow of USD 18.9m in Q2 2013 compared to an outflow USD 13.5m in Q2 2012. For the twelve months to June 2013, operating cash was USD 152.6m, representing a 132% conversion of EBITDA into operating cash.

2013 Guidance

Our guidance for 2013 on a non-IFRS basis is:

- Total non-IFRS revenue growth of 4.5% to 7.5% (implying non-IFRS revenue of USD 469m to USD 482m)*

- Software licensing growth of 5% to 10% (implying software licensing revenue of USD 131m to USD 137m)*

- Non-IFRS cost base of USD 368m with non-IFRS EBIT margin of 21.7% to 23.2% (implying non-IFRS EBIT of USD 102m to USD 112m)*

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 17% to 18%

* Based on the currency assumptions set out below which remain the same as at the Q1 results

Conference Call

At 17.30 BST / 18.30 CET / 12.30 EST, today, 29 July 2013, David Arnott, CEO, and Max Chuard, CFO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

+44 (0)1452 569 335 (UK and International)

0808 238 0673 (UK Free Call)

0445 804 038 (Swiss Local Call)

0800 650 052 (Swiss Free Call)

+1 866 655 1591 (USA Free Call)

Conference ID # 94281864

Currency Assumptions for 2013 Guidance

In preparing the 2013 guidance, the Company has taken the actual Q1 and Q2 2013 results and for the remainder of 2013 assumed the following (which are unchanged from the assumptions in the Q1 2013 results):

- USD to Euro exchange rate of 0.780;

- USD to GBP exchange rate of 0.658; and

- USD to CHF exchange rate of 0.950.

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]