Temenos Meets Full Year Outlook With Q4 Licence Growth of 17% Company Guides for 2013 Revenue and Licence Growth With Significant Margin Improvement

Geneva, Switzerland, 26 February 2013 – Temenos Group AG (SIX: TEMN), the market leading provider of mission-critical software to banks globally, today reports its fourth quarter and full year 2012 results.

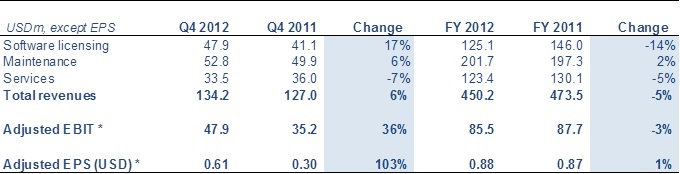

*Adjusted for non-recurring items such as restructuring charges, as well for amortisation of acquired intangibles.

- Q4 strong across all KPIs and full year results delivered within outlook range

- Strong sales to the installed base of products with shorter sales cycles and quicker payback

- 10 new customer wins in Q4 taking the total to 37 for the full year; 43 go-lives in 2012

- Adjusted EBIT margin up 8.0% pts in Q4 and up 0.5% pts for the full year

- Adjusted EPS growth of 103% in Q4 and 1% for the full year

- Cost target achieved with adjusted costs lower in Q4 than in Q3; 2013 cost base of USD 360m reaffirmed

- Operating cash inflow of USD 114m in Q4 underpinned full year cash conversion of 102%

- Net Debt / EBITDA of 1.0x at year end

- Strength of cashflows and balance sheet support initiation of annual dividend

- Change to composition of Executive Committee

- 2013 guidance of revenue and licence growth with significant margin improvement

- Medium term strategy to be presented tomorrow with targets including licence growth of 10%+ per annum

Commenting on the results, Temenos CEO David Arnott said:

2012 was a year of transition and we finished with strong momentum going into 2013, having laid the foundations in the second half of the year for sustained growth. As we expected, Q4 was strong on all KPIs with our new organisational structure improving execution. 2013 will see strong growth in revenue and profitability, underpinned by maintenance growth and lower costs which are already locked-in.

Tomorrow we will host an event for analyst and investors at which we will set out our strategy for the medium term and related targets. Temenos operates in a USD 5.5bn market, which is growing and which is underpinned by structural drivers. We have the credentials to extend our market leadership, including the largest customer base and the best record of customer success in the industry.

Our strategy is simple, builds on sound fundamentals and capitalises on our strong product and customer assets. In addition, we have a clear strategy for services and partners, which will underpin execution and help us to develop key markets. Our plan envisages strong licence and revenue growth, which coupled with operational leverage, will drive strong earnings and shareholder value creation.

Revenue

Revenue for the fourth quarter was USD 134.2m, up from USD 127.0m in the same period last year, representing an increase of 6%. Licence revenue for the quarter was USD 47.9m, 17% higher than in the same period in 2011. Total revenue in the full year was USD 450.2m, down 5% on 2012, with Licence revenue at USD 125.1m, 14% lower than the prior year.

Adjusted EBIT

Adjusted EBIT (EBIT before one-off restructuring charges and amortisation of acquired intangibles) was USD 47.9m in Q4, 36% higher than in Q4 2011. Adjusted EBIT for the full year was USD 85.5m compared to USD 87.7m in 2011, representing a 3% decrease. The adjusted EBIT margin in Q4 was 35.7%, up 8.0% pts on Q4 2011.

Adjusted Earnings per Share (EPS)

Adjusted EPS, which excludes amortization of acquired intangibles and restructuring charges, was USD 0.61 in the quarter, up from USD 0.30 in the same quarter of the previous year, which represents an increase of 103%. 2012 full year adjusted EPS was 0.88, up 1% on the previous 12 months.

Operating Cash

Operating cash was an inflow of USD 114.3m in Q4 compared to USD 124.8m in 2011. For the full year, operating cashflow was USD 97.7m representing a 102% conversion of EBITDA into operating cashflow.

Dividend

Temenos is highly cash generative with a strong balance sheet which enables investment in the business, including industry leading R&D spend, and funding for targeted acquisitions whilst also providing for returning value to shareholders.

Taking into account the growing maturity of the company and the strength of future cashflows, subject to shareholder approval at the AGM on 24 May 2013, Temenos intends to pay an initial annual dividend of CHF 0.28 (c.USD 0.30) on 31 May 2013. The dividend record date will be set on 30 May 2013 with the shares trading ex-dividend on 28 May 2013. Temenos policy is to distribute a sustainable to growing dividend.

Change to composition of Executive Committee

Mark Cullinane, formerly Director of Corporate Development and Chief Operating Officer, and Temenos have agreed to terminate their relationship as of today, 26 February 2013. Temenos values highly the contribution and achievements of Mr. Cullinane over his ten year tenure with Temenos, a period which saw the company grow significantly.

2013 Guidance

Our guidance for 2013 on a non-IFRS** basis is:

- Total non-IFRS revenue growth of 2.5% to 5.5% (implying non-IFRS revenue of USD 462m to USD 475m)***

- Licence growth of 5% to 10% (implying Licence revenue of USD 131m to USD 138m)***

- Non- IFRS cost base of USD 360m reaffirmed with non-IFRS EBIT margin of 22.0% to 23.5% (implying non-IFRS EBIT of USD 102m to USD 112m)**

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 17% to 18%

** Definition of non-IFRS to be included in the Q4 and FY results presentation

*** At constant currency

Medium Term Targets

Our medium term targets on a non-IFRS basis are:

- Non-IFRS revenue growth of 5%+ on average per annum with:

-Licence growth of 10%+ on average per annum

-Services contributing 20% to 25% of group revenue and be profitable

- Non-IFRS EBIT margin improvement of 100 to 150bps on average per annum

- 100%+ conversion of EBITDA into operating cashflow

- DSOs reducing by 10 to 15 days per annum

- Tax rate of 17% to 18%

Further details of Temenos’ strategy for 2013 and beyond will be provided at the Analyst & Investor Event to be held tomorrow (further details below).

Conference Call

At 17.30 GMT/ 18.30 CET/ 12.30 EST, today, 26 February 2013, David Arnott, CEO, and Max Chuard, CFO, will host a conference call to present results and offer an update on business outlook. Listeners can access the conference call using the following dial in numbers:

+44 (0)1452 569 335 (UK and International)

0808 238 0673 (UK Free Call)

0445 804 038 (Swiss Local Call)

0800 650 052 (Swiss Free Call)

+1 866 655 1591 (USA Free Call)

Conference ID # 93371356

To view the full press release, please click here.

A transcript will be made available on the company website 48 hours after the call.

Temenos Press Contacts

Scott Rowe

Temenos Global Public Relations

+44 20 7423 3857 [email protected]Alistair Kellie

SEC Newgate Communications for Temenos

+44 20 7680 6550 [email protected]