Your one-stop, white-label digital wallet platform

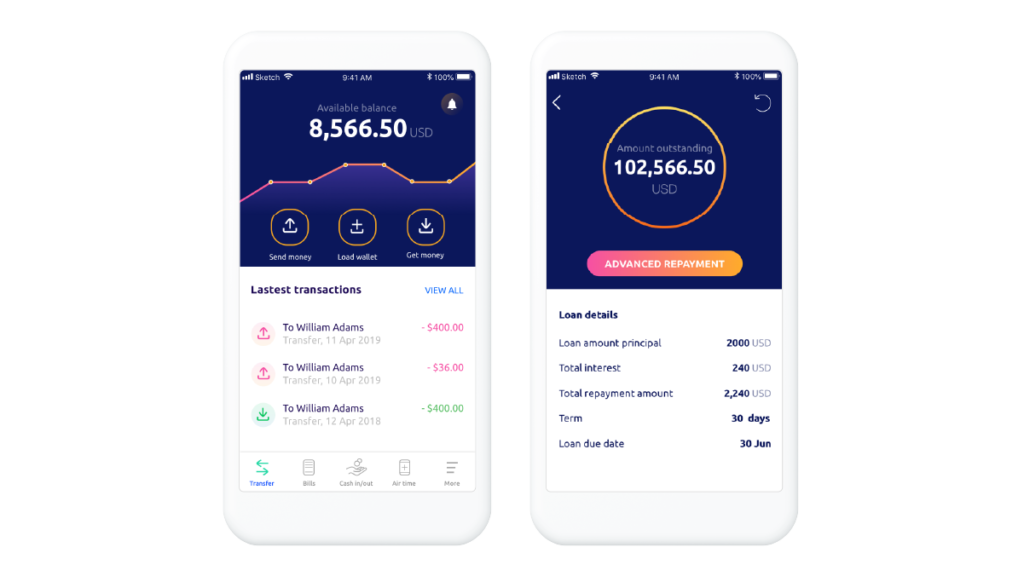

Engage customers with exceptional mobile payment experiences, such as instant P2P payments and transfers, contactless payments, digital loans, etc.

Aggregate value in your ecosystem by integrating insurance, airtime top-up, bill payments, remittances, cash in/out at agents, etc.

Software Group’s mature mobile wallet platform is your customer-centric mobile money and mobile payments solution, completely customizable to your business case.