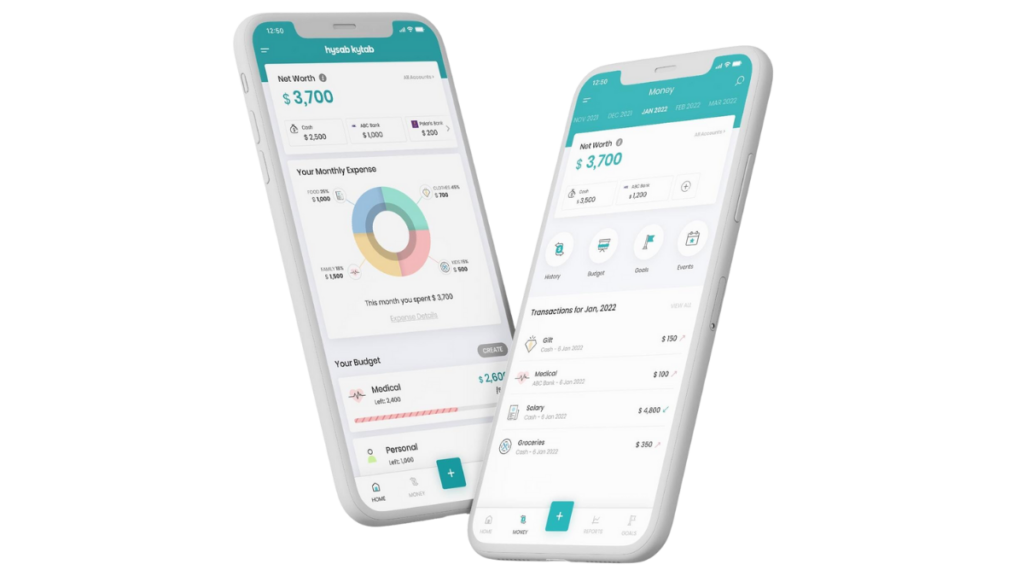

Personal Financial Management (PFM) – Hysab Kytab

Personal Financial Management (PFM)- Hyper-personalize digital banking experience through our smart money management tool.

Harness the power of PFM:

Turn insights into actions and improve your digital banking experience.

Become the financial advisor for your customers by gaining 360-degree view of their finances. Put your customers in the driving seat of their financial wellbeing by helping them make informed financial decisions.

Understand your customers’ financial dreams and identify the non-intrusive cross-selling/ up-selling opportunities for new revenue streams through hyper-personalization.

Key Features

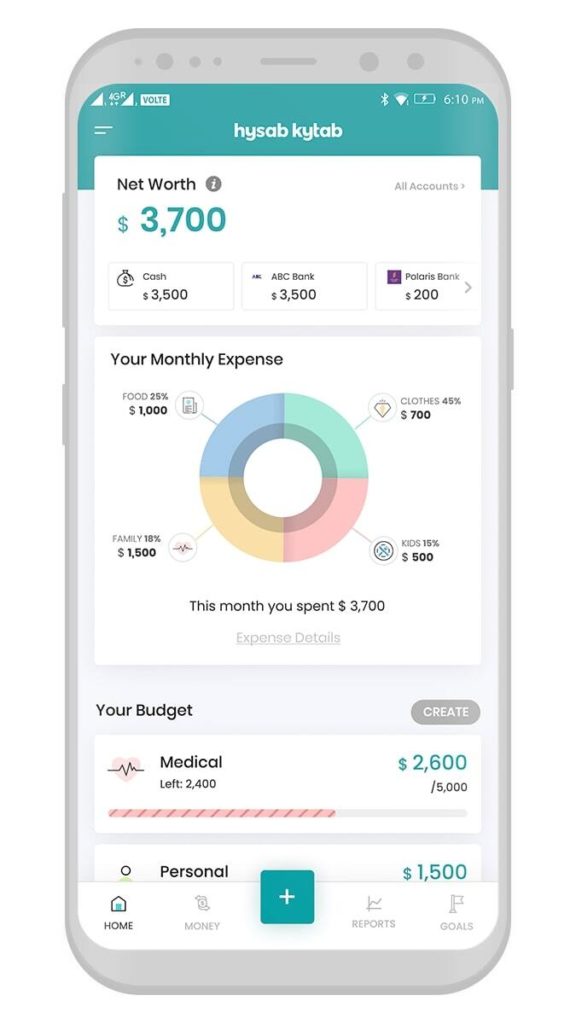

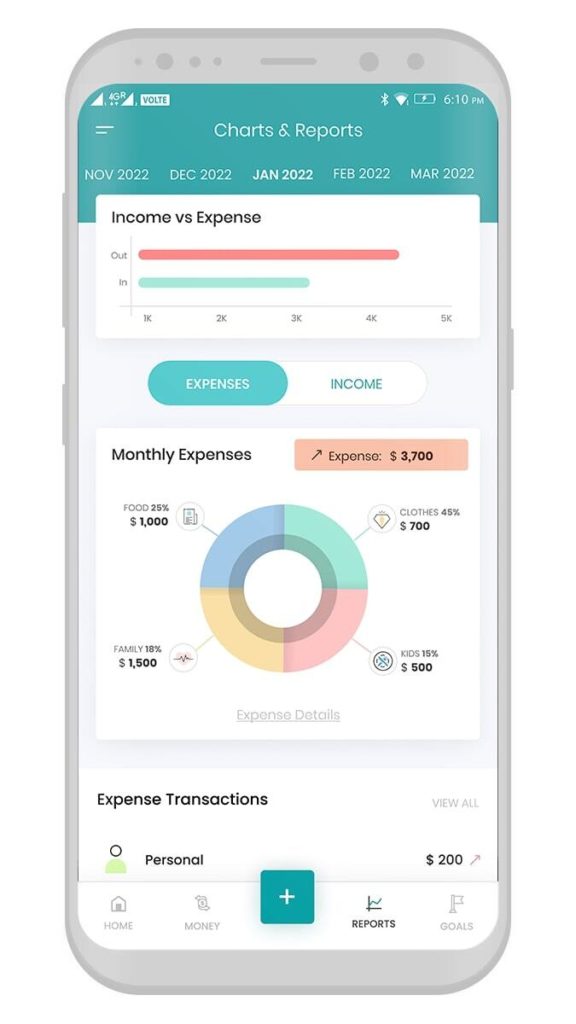

Income & Expense Tracking

Enable customers to view all financial activities in consolidated, clear, and easy-to-understand graphs and visuals which helps them understand their financial habits more effectively and avoid the potholes in their financial journey.

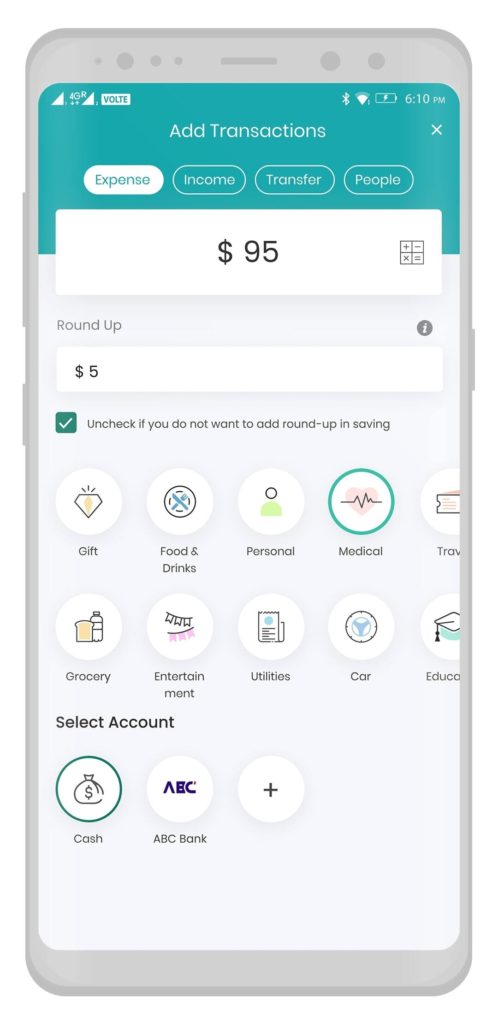

Automatic Categorization

This features automatically categorizes all financial transactions into most relevant categories and transforms the information into interactive visualizations which makes income and expenses tracking more convenient for customers.

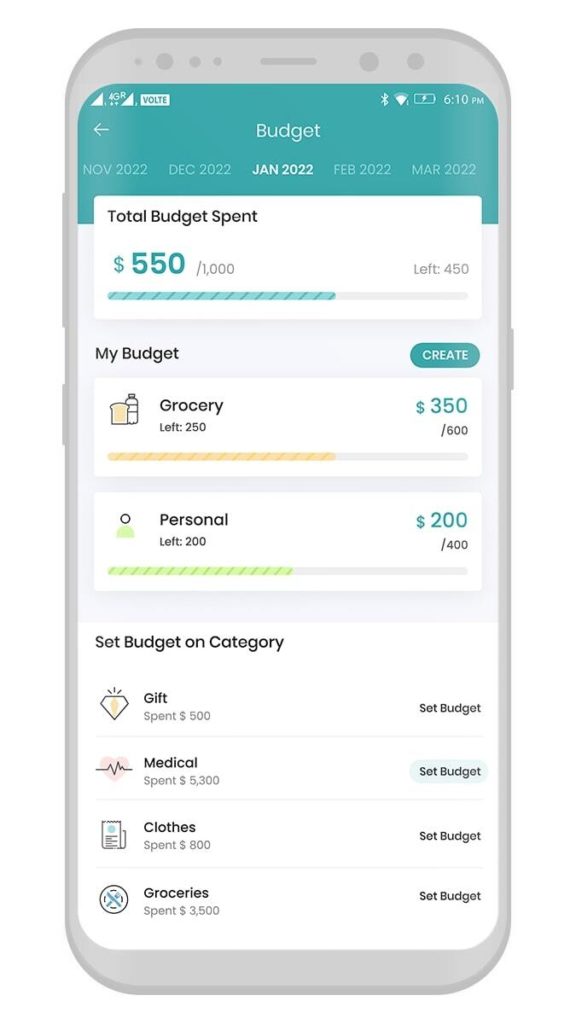

Budgeting

Enable customers improve their money management habits by letting them set their monthly budgets for various spending categories and track their performance against them so that the money saved can be put into action.

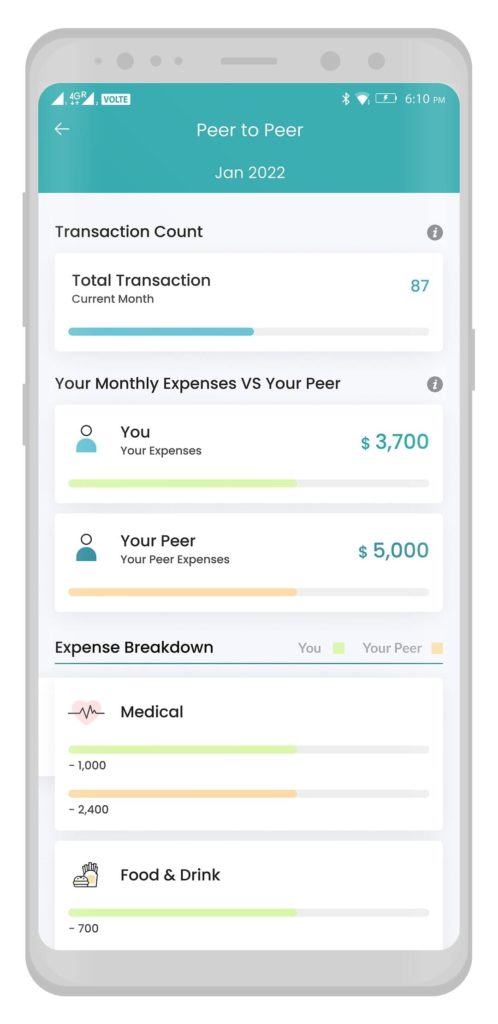

Peer Comparison

Customers can anonymously compare their financial behavior with peers. Peer groups can be determined by setting demographic attributes such as age, gender, income, expense categories etc.

Saving Jar

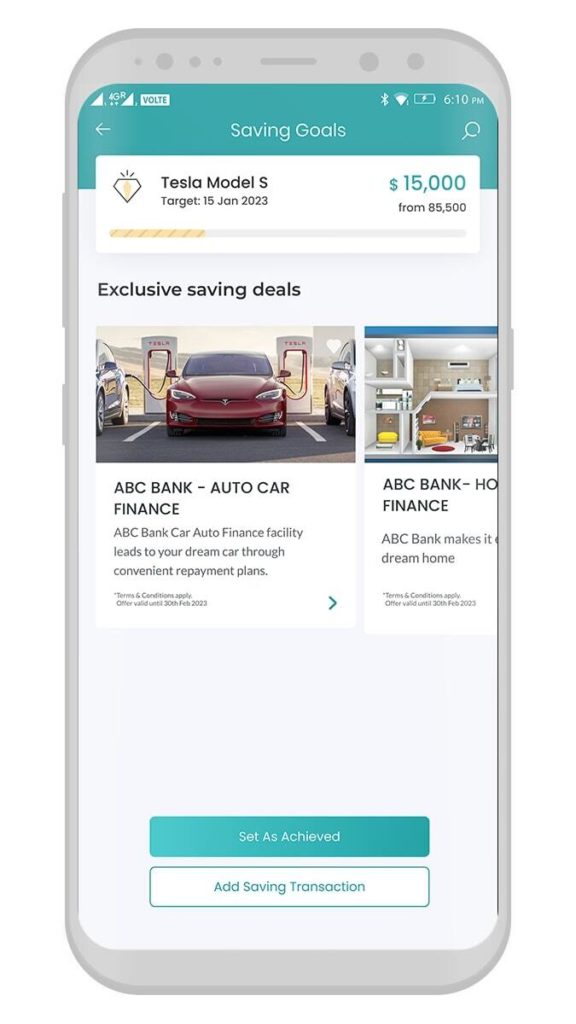

Saving Goal

This feature helps bank customers in developing saving habits and achieving financial goals. It enables customers to set up both short- term and long-term saving goals and makes progress tracking incredibly easy.

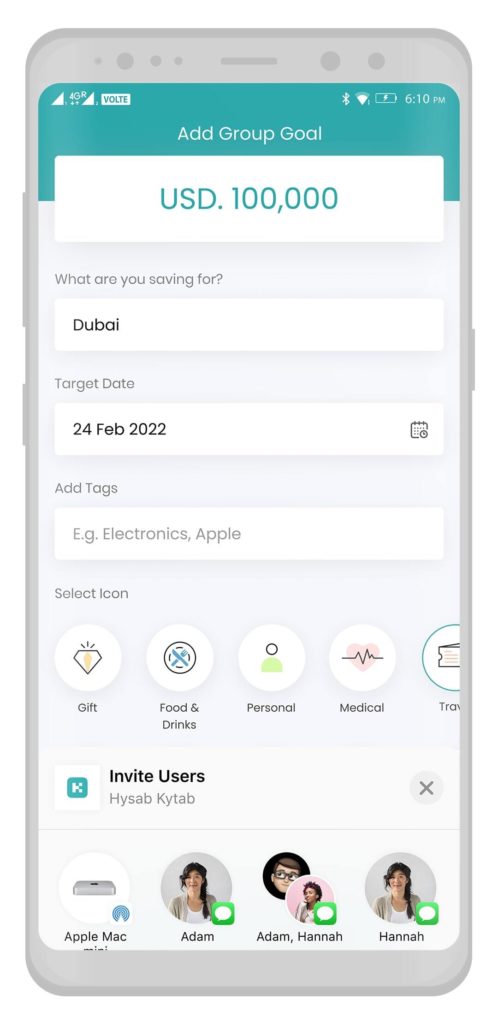

Group Saving Goal

Hysab Kytab PFM allows customers to create saving goals with their family and friends to inspire people around them for adopting better financial habits. This feature allows the banks to acquire potential new customers while increasing the deposit at the bank.

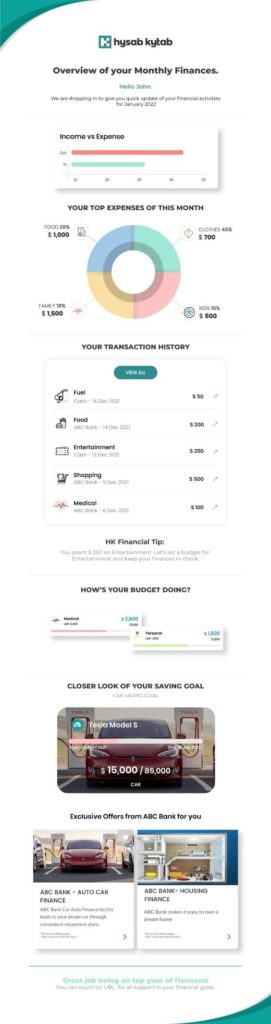

PFM Statement

Monthly e-statement reimagined with actionable insights providing infographic view of PFM activities highlighting top monthly expenses, expense history, exclusive saving deals, budgets & saving goals performance, peer comparison and financial tips.

Backoffice Analytics Dashboard

Understand your customers financial activities/trends through AI and predictive analyses for empowering your Backoffice team on next best action.