Acquire your next generation of customers

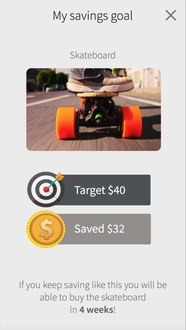

Chore Scout is an app for banks to acquire children and their parents as customers. It lets parents set chores around the home. As the children complete the chores they receive their allowances, transferred from mum and dad’s bank account into theirs, which can then be used to save for goals such as skateboards and Lego or converted into cash. Chore Scout teaches fundamental financial literacy skills such as saving and the value of money and acts as a customer acquisition tool for banks.

Overview

Acquire Youth Customers

Customers who have banked with a provider throughout their early years are far more likely to extend this relationship into their student days and beyond when profit contribution increases significantly. Research indicates that only 10% would consider changing banks once their relationship is established, reinforcing the view that the youth segment is the optimum point of market entry. This existing relationship delivers a clear advantage when financial institutions are attempting to access friends and family of their existing account holder, with “92% of consumers saying they trust word of mouth and recommendations from friends and family above all other forms of advertising. Having a savings accounts in childhood is associated with being two times more likely to own savings accounts, two times more likely to own credit cards, and four times more likely to own stocks in young adulthood, compared to not having savings accounts in childhood. A wide variety of studies suggest a positive relationship between the ownership of a savings account and higher levels of economic and financial wellbeing such as savings, income, and assets, as well as academic achievement and educational attainment. By examining the journey below, a bank can begin to choose when to begin working with customers to help them win and build a bank of great customers.

Improve your Brand

The global financial landscape is becoming increasingly sophisticated with accelerating adoption of innovative financial technology. Serving highly technologically literate children and youth can help financial institutions rethink and perhaps diversify the services and distribution channels they offer. This in turn can have a positive impact on brand perception – the financial institution can meet/exceed/lead market needs – therefore attracting more customers.

Corporate and Social Responsibility

Financial institutions have a key role to play in laying the groundwork for youth to realize their potential. By offering child and youth friendly financial services, banks offer children and youths a chance to believe in themselves, save for a better future, build a savings record, make payments and access other essential financial services. By learning how to manage their own resources, children can develop the necessary life skills, and skills needed for employment or entrepreneurship. Changing a young person’s life can be that simple. There are 2.2 billion children (aged 0-18) and approximately 1.2 billion youth (aged 15-25) in the world. As leaders in finance and economies, financial institutions have an opportunity to create the next generation of entrepreneurs, business leaders, and responsible economic citizens. Financial inclusion for these groups is key to unlocking intergenerational cycles of poverty, indebtedness, school dropout and unemployment. Financial institutions who decide to address these issues broaden their playing field while addressing their social responsibility. According to the World Savings and Retail Banking Institute people need the ability to act financially through education, knowledge, skills, confidence and motivation, and access to adequate banking services and responsible institutions. Without access to these types of banking products they will not build the skills necessary to learn how to use complex financial services in a productive and responsible manner later in life.

Untapped savings market

On average 37.9% of youngsters aged 15 – 25 have accounts at a formal financial institution. OECD countries and East Asia and the Pacific are above this average, whilst penetration in the Middle East is as low as 12.9%. In Eastern Europe and central Asia, these rates are as low as 3.98% With low cost, mobile solutions that are fun and relevant this market can be captured. A 2013 global CYFI study of 135 banks, representing over 1 billion retail customers and over €39 trillion in assets found that child and youth financial inclusion was a sustainability priority for less than 5% of banks. This compares with CBA who attest that 20% of their savings volume is “youth related”.