Temenos Announces Outstanding Q4 and FY 2018 Results, Confirms Strong 2019 Outlook

New Chief Executive Officer and Chief Financial Officer Appointed

- Temenos FY 2018 results exceed revised guidance on broad based demand

- Strong start to 2019, strong outlook for the year confirmed

- Incremental growth in SaaS and cloud with Total Contract Value up over 6x in 2018

- Very high revenue visibility driven by pipeline growth and committed spend

- Acquisition of Avoka, a US based leader in customer acquisition and onboarding, closed in December

- Board announces Max Chuard, CFO and COO, to succeed David Arnott, CEO, who steps down effective 28th February

- Board announces Panagiotis “Takis” Spiliopoulos, Head of Research for Vontobel, a leading Swiss Bank, joins as CFO on 31st March 2019

- Max Chuard confirms continuation of successful strategy to drive next phase of growth

GENEVA, Switzerland, 12 February 2019 – Temenos AG (SIX: TEMN), the banking software company, today reports its fourth quarter and full year 2018 results. It also announces that Chief Financial Officer and Chief Operating Officer Max Chuard has today been appointed as Chief Executive Officer to succeed David Arnott, who after 18 years with the company is stepping down to spend more time with his new family and baby as part of a managed transition to ensure continuity of strategy and execution. In addition, Panagiotis “Takis” Spiliopoulos will join as Chief Financial Officer effective 31st March 2019.

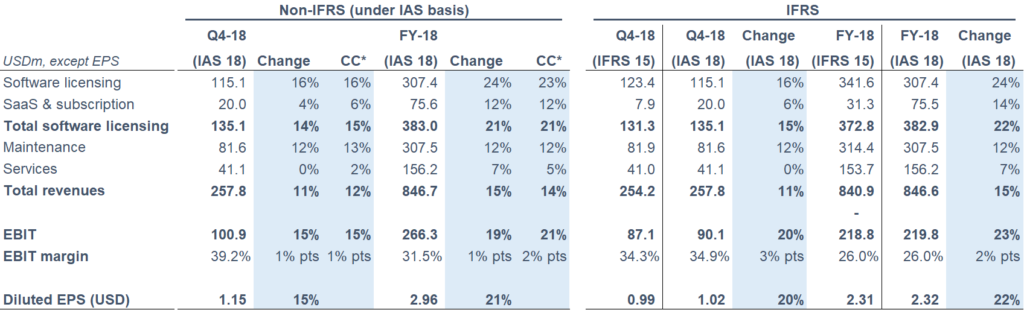

* Constant currency (c.c.) adjusts prior year for movements in currencies

Please note that non-IFRS numbers are under IAS 18 and comparable to the prior periods. IFRS numbers are under IFRS 15 and a full reconciliation is provided in the appendix.

Q4 and FY 2018 highlights

- Outstanding performance in 2018 with broad based demand across geographies and tiers

- Digital and regulatory pressures and move to open banking are driving market growth

- Signed two strategically important deals in US: a top tier US bank for visionary front office replacement and PayPal, Inc. for loan management in the cloud

- 28 new customer wins in the quarter, total of 76 in FY 2018

- Tier 1 and 2 banks contributed 66% of total software licensing in Q4 and 53% in FY 2018

- Significant increase in appetite for cloud adoption and SaaS

- Market leader, raising barriers to entry and pulling ahead of the competition

Q4 and FY 2018 financial summary (non-IFRS, IAS 18)

- Non-IFRS total software licensing revenues up 15% in Q4 18 and up 21% in FY 18 c.c.

- Non-IFRS maintenance growth of 13% in Q4 18 and 12% in FY 18 c.c.

- Non-IFRS total revenue growth of 12% in Q4 and 14% in FY 18 c.c.

- SaaS Total Contract Value up over 6x in 2018 to reach USD 59m

- Non-IFRS EBIT up 15% in Q4 18, FY 18 non-IFRS EBIT margin of 31.5%

- FY 18 non-IFRS EPS increase of 21% to USD 2.96

- FY 18 cash conversion of 117%

- DSOs down 5 days Y-o-Y to 114 days

- Profit and cash flow strength support proposed dividend of CHF0.75, a 15% annual increase

- 2019 guidance of non-IFRS total software licensing growth of 17.5% to 22.5% (c.c.), non-IFRS total revenue growth of 16% to 19% (c.c.) and non-IFRS EBIT of USD 310m to 315m (guidance under IFRS 15)

Commenting on the results, Temenos CEO David Arnott said:

“We have delivered another very strong set of results in Q4 and for the full year 2018. Our end market continues to accelerate and we are capitalizing on this momentum to drive significant growth in our business. The excellent performance this year has been broad based across all geographies, which reflects the pressures on banks globally to fundamentally transform their IT systems to be fit for purpose.

In 2018 we had many milestones, including expanding our market presence in the US with some key wins and the acquisition of Avoka, signing a strategically important deal with a top tier US bank for digital front office, and leading the market globally among both traditional banks as well as neo-banks and new entrants. Our performance is down to the dedication and hard work of all our colleagues who have demonstrated their ability to consistently execute at a very high standard.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“We have had a very strong performance in 2018, with total software licensing growth of 21% and total revenue growth of 14%. We also grew profit by 21% and delivered margin expansion of 111bps year-on-year. The investments we have made in our products and our sales and marketing are clearly paying off, and our clients recognize our relentless focus on innovation which they benefit from when working with us to transform their IT platforms.

The strength of our cash flows means we are recommending a 2018 dividend of CHF 0.75, an increase of 15% on 2017. The outlook for 2019 is very strong, and this is reflected in our guidance for the year. We are guiding for non-IFRS total software licensing growth of 17.5% to 22.5% and non-IFRS total revenue growth of between 16% and 19%. We are guiding for 2019 non-IFRS EBIT of USD 310m to 315m, which implies a margin of c.31.7%. Our revenue visibility is very high, driven by our pipeline growth and committed spend.”

Revenue

IFRS (IFRS 15) revenue for the quarter was USD 254.2m.

IFRS (IAS-18) revenue were USD 257.8m, an increase of 11% vs. Q4 2017.

Non-IFRS (IAS 18) revenue was USD 257.8m for the quarter, an increase of 11% vs. Q4 2017.

IFRS (IFRS 15) total software licensing revenue for the quarter was USD 131.3m.

IFRS (IAS 18) total software licensing revenue for the quarter was USD 135.1m, an increase of 15% vs. Q4 2017.

Non-IFRS (IAS 18) total software licensing revenue was USD 135.1m for the quarter, an increase of 14% vs. Q4 2017.

EBIT

IFRS (IFRS 15) EBIT was USD 87.1m for the quarter.

IFRS (IAS 18) EBIT was USD 90.1m for the quarter, an increase of 20% vs. Q4 2017.

Non-IFRS (IAS 18) EBIT was USD 100.9m for the quarter, an increase of 15% vs. Q4 2017.

FY 2018 non-IFRS (IAS 18) EBIT margin was 31.5%, up 1.1% point vs. FY 2017.

Earnings per share (EPS)

IFRS (IFRS 15) EPS for the quarter was USD 0.99.

IFRS (IAS 18) EPS was USD 1.02 for the quarter, an increase of 20% vs. Q4 2017.

Non-IFRS (IAS 18) EPS was USD 1.15 for the quarter, an increase of 15% vs. Q4 2017.

Operating cash flow

IFRS (IFRS 15) operating cash was an inflow of USD 365.1m in FY 2018 compared to USD 299.7m in FY 2017, representing a conversion of 117% of IFRS (IAS 18) EBITDA into operating cash.

Dividend

Taking into account the strength of profit growth and cash generation, as well as the expected strength of future cash flows, subject to shareholder approval at the AGM on 15 May 2019, Temenos intends to pay a dividend of CHF 0.75 per share for 2018. The timing for the dividend payment will be as follows:

- 15 May AGM approval

- 17 May Shares trade ex-dividend

- 20 May Record date

- 21 May Payment date

As with previous years, the 2018 dividend will be paid as a distribution of capital contribution reserves and therefore be exempted of withholding tax. Temenos’ policy is to distribute a sustainable to growing dividend.

Appointment of new CEO and CFO

After 18 years with Temenos, David Arnott is stepping down from his role as CEO to spend more time with his young family. He will remain as CEO until 28th February. The Board of Directors have a robust succession plan in place for all Executive Committee and senior management roles. They are pleased to announce that Max Chuard, CFO and COO, will be appointed CEO effective from 1st March 2019 in a managed transition to ensure continuation of strategy and execution.

Max Chuard has been with Temenos for 17 years and has had wide-ranging responsibilities including Strategy, M&A, Finance, and was appointed as CFO in 2012. He took on additional client-facing responsibilities in 2015 when he also appointed as COO and he has been integral in client relationship management, sales and delivery as well as the planning and successful execution of Temenos’ strategy. The Board is confident he is best placed to continue the execution of this winning strategy as Temenos enters its next phase of growth.

The Board of Directors are also pleased to announce the appointment of Panagiotis “Takis” Spiliopoulos as CFO. Mr. Spiliopoulos was previously Head of Research and a member of the Investment Bank management board for Vontobel, a leading Swiss bank. He brings a unique and extensive skill set to the role across strategy, finance, operations and management, as well as deep technology sector expertise, which will be key to driving Temenos’ growth. Having followed the company since IPO, Mr. Spiliopoulos is a strong cultural fit for the business. He will join Temenos from 31st March 2019.

Commenting on the announcement, Temenos Executive Chairman of the Board Andreas Andreades said:

“We are very grateful for the leadership and dynamism that David has brought to Temenos over the last 18 years. He has been integral in taking the company from strength to strength and building Temenos into a global leader. We wish him all the best as he steps down to spend more time with his young family.

I hired David myself 18 years ago and Max 17 years ago. Everything we have achieved with Temenos over the past 17 years we did together. I know David has been thinking about his position since he started his new family several months ago which brings me to today’s announcement.

On behalf of the Board of Directors, I am pleased to announce the appointment of Max Chuard as CEO, effective from 1st March. Max has extensive knowledge and understanding of the business and has been key to our success over the past 17 years. We are fortunate to have such a deep bench of talent to draw on, and I am confident Max will continue the successful execution of our strategy and drive the growth in our business as we enter this new phase.

We are also pleased to announce that Panagiotis “Takis” Spiliopoulos will be joining us as CFO. He brings a depth of strategic vision and understanding of Temenos and the technology space that will be critical as we extend our leadership position. I have been very privileged to work with David and Max and look forward to working with the new management team to continue delivering success for all our stakeholders.”

David Arnott said:

“After discussions with my family and after 18 years with Temenos, I have decided now is the best time for me to step down to spend more time with my family and our new baby. I am very proud of what Temenos has become over my time with the company, having achieved so many major milestones. I want to say thank you to all of our employees, clients, partners, shareholders and other stakeholders for the support they have given me.”

Max Chuard said:

“I am honored and hugely excited to become CEO of Temenos. We have a very significant opportunity in front of us and I am confident we can continue executing our highly successful strategy to drive Temenos in this next phase of growth.”

Panagiotis “Takis” Spiliopoulos said:

“I am delighted to be joining Temenos as CFO. I have followed the company closely since its IPO in 2001 and have always believed in its strategy and potential. I am very excited to have the opportunity to contribute to and help shape the company. I look forward to meeting and working with all our stakeholders over the coming years to achieve our strategic vision.”

2019 guidance

Our guidance for 2019 is in constant currencies and under IFRS 15. The guidance is as follows:

- Non-IFRS total software licensing growth at constant currencies of 17.5% to 22.5% (implying non-IFRS total software licensing revenue of USD 438m to USD 457m)

- Non-IFRS revenue growth at constant currencies of 16% to 19% (implying non-IFRS revenue of USD 975m to USD 1,000m)

- Non-IFRS EBIT at constant currencies of USD 310m to 315m, (implying non-IFRS EBIT margin of c. 31.7%, or 130bps expansion organically excluding the impact of Avoka)

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2019 tax rate of 15% to 16%

Currency assumptions for 2019 guidance

In preparing the 2019 guidance, the Company has assumed the following:

- USD to Euro exchange rate of 0.851;

- USD to GBP exchange rate of 0.750; and

- USD to CHF exchange rate of 1.00.

Medium term targets

Our medium term targets are as follows:

- Non-IFRS total software licensing growth of at least 15% CAGR

- Non-IFRS revenue growth of 10% – 15% CAGR

- Non-IFRS EBIT margin improvement of 100 to 150bps on average p.a.

- Non-IFRS EPS growth of at least 15% CAGR

- Cash conversion over 100% of EBITDA p.a.

- DSOs reducing by 5-10 days p.a.

- Tax rate of 17% to 18%

Conference call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 12 February 2019, Andreas Andreades, Executive Chairman, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 740 377 (Swiss Free Call)

1 866 966 1396 (USA Free Call)

0800 376 7922 (UK Free Call)

+44 (0) 207 192 8000 (UK and International)

Conference ID # 4995217

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed here.

IFRS 15 and IFRS 16

Temenos has implemented IFRS 15 for reporting period 1st January 2018 onwards using the modified retrospective method. Under the modified retrospective method the 2017 and prior results will not be restated under IFRS 15. The reporting of the results for 2018 have been provided under IAS 18 and under IFRS 15. From 2019, the reporting results will only be provided under IFRS 15.

Temenos has implemented IFRS 16 for reporting period 1st January 2019 onwards using the modified retrospective method. Under the modified retrospective method the 2018 and prior results will not be restated under IFRS 16. From 2019, the reporting results will only be provided under IFRS 16.

For more information on the impact of IFRS 15 and IFRS 16, please visit the Temenos Investor Relations website.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2019 non-IFRS guidance:

- FY 2019 estimated deferred revenue write down of USD 4m

- FY 2019 estimated amortisation of acquired intangibles of USD 45m

- FY 2019 estimated restructuring costs of USD 5m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after 12 February 2019. The above figures are estimates only and may deviate from expected amounts.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]